The Latest Foreclosure

Horror The Zombie Title ![]()

The banks are in it for the money. Walking away, leaving the little people with

the problems is the way to go, for bankers it is the only way.

Bill Clinton's Role in the Mortgage Crisis

QUOTE

What Hath Clinton Wrought?

What can be said in Clinton's favor is that in 1999 few people anticipated

the out-of-control growth of the hedge fund industry and the subprime

mortgage market. The New York Times described the new financial

world created by the repeal of Glass-Steagall in

a June 2007 profile of Goldman Sachs:

While Wall Street still mints money advising companies on mergers and taking them public, real money — staggering money — is made trading and investing capital through a global array of mind-bending products and strategies unimaginable a decade ago.

Curiously, Goldman Sachs head Lloyd Blankfein [ a Jew ] paints the perfect big picture of what has happened:

We’ve come full circle, because this is exactly what the Rothschilds or J. P. Morgan, the banker were doing in their heyday. What caused an aberration was the Glass Steagall Act.

Blankfein's analysis testifies to the full impact of Bill Clinton's

actions, for like many members of the Counterrevolution he sees the New Deal

as an aberration and longs for a return to the days J. P. Morgan and other

tycoons gave the Gilded Age its nickname. His "aberration" was eliminated

not because of the actions of some radical Republican, but because of Bill

Clinton. No wonder Goldman Sachs is also a prime contributor to

you-know-who.

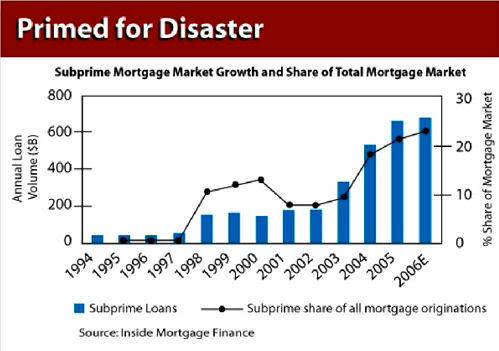

As is often the case, the story of the repeal of Glass-Steagall and the

growth of the subprime mortgage market that is now crumbling around us like

a financial house of cards can be best be told by

a graph:

If you think of this graph as the level playing field, notice how flat it

was before Bill Clinton repealed Glass-Steagall, then notice how steep it

has become. Those subprime loans amount to nothing more than an organized

rip-off of millions of innocent Americans, with the steepness of the graph

illustrating the how far the playing field has tilted.........

The Future of Your Mortgage

In

testimony before Congress on November 8, Federal Reserve Chair

Ben Bernanke [ a Jew

] painted a grim picture of the current crisis and even grimmer

picture of the future:

On average from now until the end of next year, nearly 450,000 subprime mortgages per quarter are scheduled to undergo their first interest rate reset. [My emphasis]

According to a December 2006 study by the Center for Responsible Lending, a nonpartisan research and policy organization:

More than 2 million people with subprime loans are facing foreclosure this year and nearly 20 percent of subprime mortgages issued between 2005 and 2006 are projected to fail.

But numbers and testimony and even history mean little to those who suddenly find themselves up against the wall. In every city and town across this country "For Sale" signs are popping up on lawns. Behind each of those signs lies a personal story, a family tragedy, which like the tragedies of the Great Depression, tells of innocent Americans felled by an affliction they never saw coming.....

And the current crop of politicians? Look closely at their donor lists,

which I detailed in the series "Follow

the Money." Then wonder why no moderator or other candidate has asked

Hillary Clinton if she supports her husband's repeal of Glass-Steagall? Ask

the other candidates if they support Bill Clinton's move.

Meanwhile the signs keep sprouting and the playing field keeps tilting and

soon the snow will start to fall, drifting against the signs. How many more

people will have lost their homes when the snow melts?

UNQUOTE

A leftie writes. He reads as a fair man. Notice always the number of Jews in

the finance industry, Jews who are very decidedly not victims.

Bill Clinton's

Drive To Increase Home Ownership Went Way Too Far

QUOTE

Add

President Clinton to the long list of people who deserve a share of the blame

for the housing bubble and bust. A recently re-exposed document shows that his

administration went to ridiculous lengths to increase the national

homeownership rate. It promoted paper-thin down payments and pushed for ways to

get lenders to give mortgage loans to first-time buyers with shaky financing

and incomes. It’s clear now that the erosion of lending standards pushed

prices up by increasing demand, and later led to waves of defaults by people

who never should have bought a home in the first place.

President Bush continued the practices because they dovetailed with his Ownership Society goals, and of course Congress was strongly behind the push. But Clinton and his administration must shoulder some [ some/most/a lot/all? ] of the blame.........

The Clinton-era document that Mason cites—“The National

Homeownership Strategy: Partners in the American Dream”—was hiding in plain

sight on the website of the Department of Housing & Urban Development until last

year, when according to Mason it was removed (probably because the housing bust

made it seem embarrassing to the department). Mason credits Joshua Rosner of

Graham Fisher & Co. with saving a copy of it before it was expunged.

UNQUOTE

Commentators are not keen on fingering Clinton. I am.

Minorities'

Home Ownership Booms Under Clinton but Still Lags White Peoples'

QUOTE

It's one of the hidden success stories of the Clinton era. In the great

housing boom of the 1990s, black and Latino homeownership has surged to

the highest level ever recorded. The number of African Americans owning

their own home is now increasing nearly three times as fast as the number

of whites; the number of Latino homeowners is growing nearly five times as

fast as that of whites. [ My emphasis - Editor ]

These numbers are dramatic enough to deserve more detail. When President Clinton took office in 1993, 42% of African Americans and 39% of Latinos owned their own home. By this spring, those figures had jumped to 46.9% of blacks and 46.2% of Latinos. That's a lot of new picket fences. Since 1994, when the numbers really took off, the number of black and Latino homeowners has increased by 2 million. In all, the minority homeownership rate is on track to increase more in the 1990s than in any decade this century except the 1940s, when minorities joined in the wartime surge out of the Depression.

This trend is good news

on many fronts.

UNQUOTE

It sounded good - at the time, to the well meaning, the poor, the

unsophisticated. The cunning liked it too but for different reasons.

They Gave Your

Mortgage to a Less Qualified Minority [ AKA Efnick ]

QUOTE

Before the Democrats' affirmative action lending policies became an

embarrassment, the Los Angeles Times reported that, starting in 1992, a

majority-Democratic Congress "mandated that Fannie and Freddie increase their

purchases of mortgages for low-income and medium-income borrowers. Operating

under that requirement, Fannie Mae, in particular, has been aggressive and

creative in stimulating minority gains."

Under Clinton, the entire federal government put massive pressure on banks to

grant more mortgages to the poor and minorities. Clinton's secretary of

Housing and Urban Development, Andrew Cuomo, investigated Fannie Mae for

racial discrimination and proposed that 50 percent of Fannie Mae's and Freddie

Mac's portfolio be made up of loans to low- to moderate-income borrowers by

the year 2001.......

Threatening lawsuits, Clinton's Federal Reserve demanded that banks treat

welfare payments and unemployment benefits as valid income sources to qualify

for a mortgage. That isn't a joke -- it's a fact.

When Democrats controlled both the executive and legislative branches,

political correctness was given a veto over sound business practices.

In 1999, liberals were bragging about extending affirmative action to the

financial sector. Los Angeles Times reporter Ron Brownstein hailed the Clinton

administration's affirmative action lending policies as one of the "hidden

success stories" of the Clinton administration, saying that "black and Latino

homeownership has surged to the highest level ever recorded." [ See

the previous quote - Editor ]..........

Now, at a cost of hundreds of billions of dollars, middle-class taxpayers are

going to be forced to bail out the Democrats' two most important constituent

groups: rich Wall Street bankers and welfare recipients.

Political correctness had already ruined education, sports, science and

entertainment. But it took a Democratic president with a Democratic congress

for political correctness to wreck the financial industry.

UNQUOTE

Ann Coulter does not beat about the bush but then she does not have too. The

left are the ones who need the excuses, the lies, the evasions.

Mortgage Discrimination ex Wiki

QUOTE

Mortgage discrimination or mortgage lending discrimination is

the practice of banks, governments or other lending institutions denying

loans to one or more groups of people primarily on the basis of race,

ethnic origin, sex or religion. One of the most notable instances of

widespread mortgage discrimination occurred in United States

inner

city neighborhoods from the 1930s up until the late 1970s. There is

evidence that the practice still continues in the United States today.

Background

African Americans and other minorities found it nearly impossible to

secure mortgages for property located in

redlined

zones.

The systematic denial of loans was a major contributor to the

urban

decay that plagued many American cities during this time period.

Minorities who tried to buy homes continued to face direct discrimination

from lending institutions into the late 1990s. The disparities are not

simply due to differences in creditworthiness.

With other factors held constant, rejection rates for Black and Hispanic

applicants was about 1.6 times that for Whites in 1995.

Fairness in lending was improved by the

Home Mortgage Disclosure Act, passed in 1975. It requires banks to

disclose their lending practices in the communities they serve. In the

1970s, the private sector fight against mortgage discrimination began to be

led by

community development banks, such as

ShoreBank

in Chicago.

UNQUOTE

This is

Wikipedia doing what the Wikipedia does best, perverting the truth to help an

agenda. It makes blacks into victims of nasty Americans rather than bad

credit risks which they are.

Guess

Again Who's To Blame For The US Mortgage Meltdown

QUOTE

While many pundits are pointing to corporate greed and a lack of government

regulation as the cause for the American mortgage and financial crisis, some

analysts are saying it wasn’t too little government intervention that

cased the mortgage meltdown, but too much, in the form of activists

compelling the government to pressure Freddie Mac and Fannie Mae into unsound –

though politically correct – lending practices.

“Home mortgages have been a political piñata for many decades,” writes Stan

J. Liebowitz, economics professor at the University of Texas at Dallas, in a

chapter of his forthcoming book,

Housing America: Building Out Of A Crisis.

Liebowitz puts forward an explanation that he admits is “not consistent with

the nasty-subprime-lender hypothesis currently considered to be the cause of the

mortgage meltdown.” In a nutshell, Liebowitz contends that the federal government over the last

20 years pushed the mortgage industry so hard to get minority homeownership up,

that it undermined the country’s financial foundation to achieve its goal.

UNQUOTE

A Jew [ probability > 99% ] explains the problem.